Future Takeback Notifications or Interest on the Remit

Provider Level Adjustment for a Future Takeback

The Insurance can signify that a Takeback will happen in the future.

- The actual Takeback will be done on another future remit.

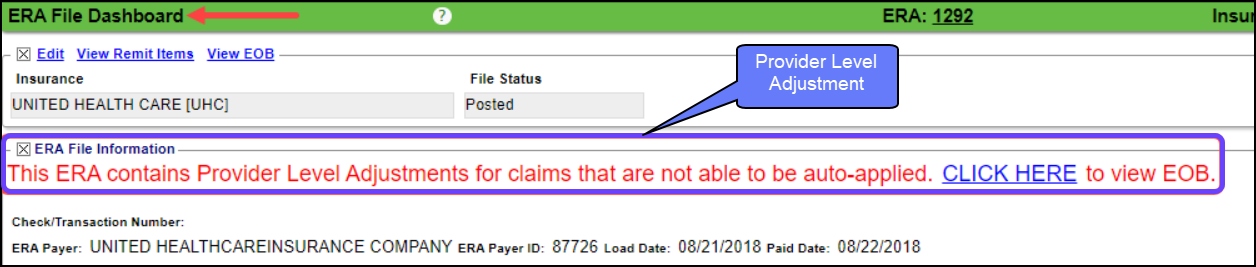

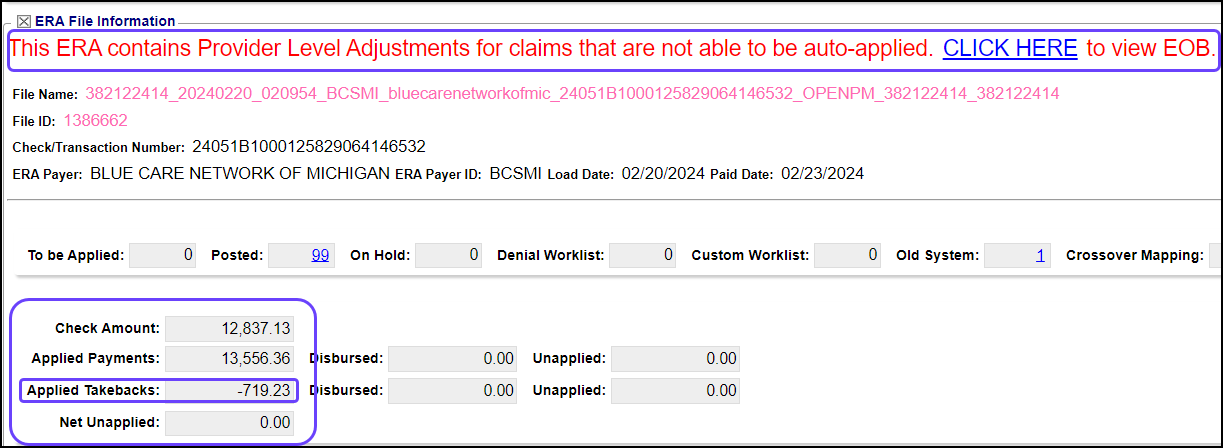

- On the ERA File Dashboard, this message will be displayed:

This ERA contains Provider Level Adjustments for claims that are not able to be auto-applied. CLICK HERE to view EOB.

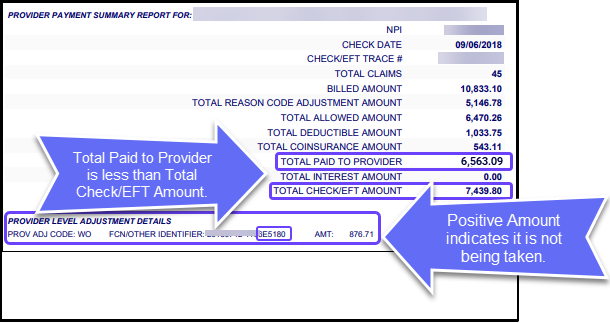

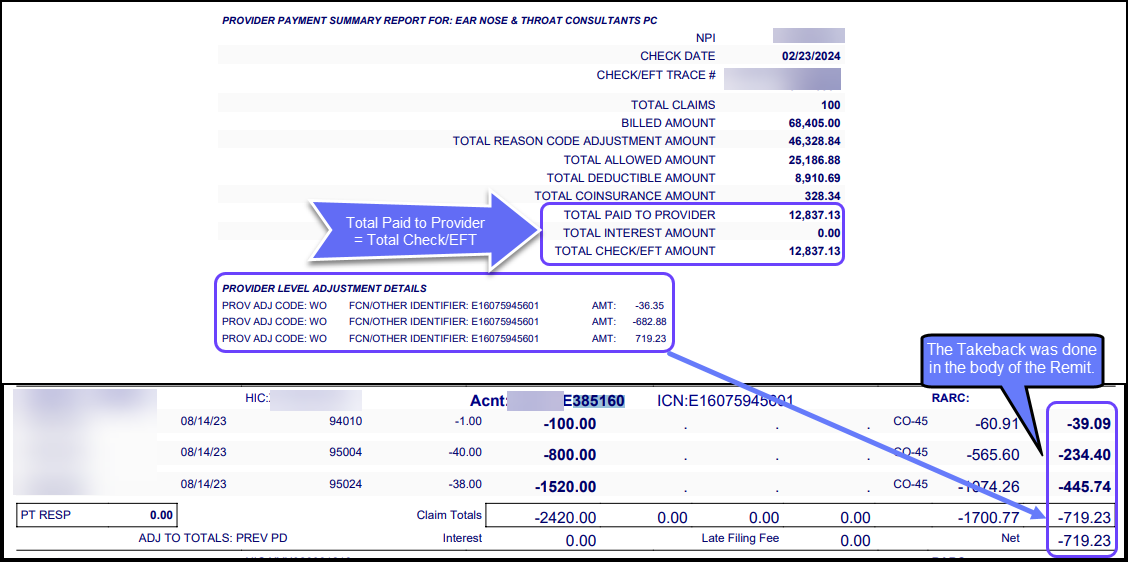

Near the bottom of the EOB, there will be a section giving additional details.

- If the Total Paid to Provider is less than the Total Check/EFT Amount, a future Takeback or Interest paid to the Provider is usually indicated.

- This is a notification that a Takeback is coming on a future Remit or Interest is being paid on this Remit.

- If this Transaction is a future Takeback, it should not be posted on this Remit.

- The Takeback will be on a future Remit, which is where it should be posted.

- If it is Interest being Paid to the Provider, it should be posted on this Remit.

Example 1: On the Example below, the difference between the Total Paid to Provider and the Total Check/EFT Amount is $876.71 which is the amount indicated in the Provider Level Adjustment Details.

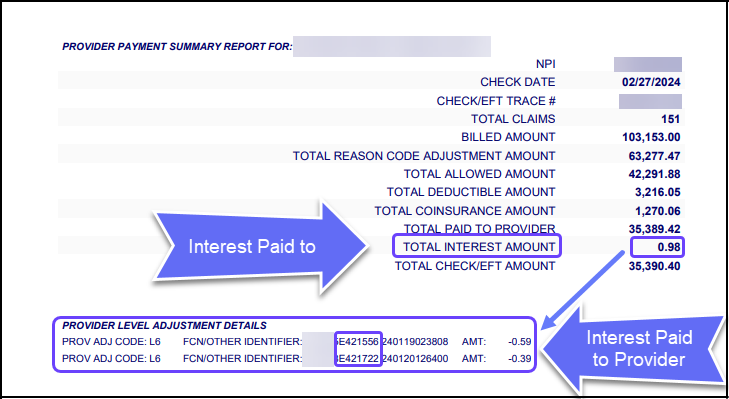

Example 2: In this Example, Interest is being paid to the Provider (0.98).

- Total Paid to Provider ($35,389.42) is less than the Total Check/EFT Amount ($35,390.40).

- Total Interest Paid is $0.98 (-$0.59 and -$0.39 = -$0.98).

- The negative amount in the Provider Level Adjustment Details indicates that it is being paid to the Provider. (The opposite of what you would think)

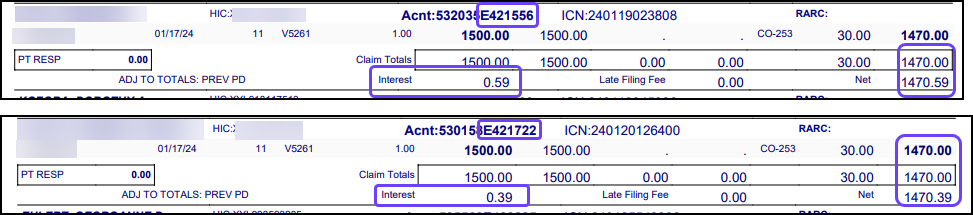

- The Interest can also be found in the body of the Remit.

- Note the Encounter number in the Provider Level Adjustment Details and in the body of the Remit.

- This Interest amount should be posted on this Remit. (Post Interest)

Interest in the body of the Remit

Takeback on the Line Level

In some cases, the EOB indicates a Takeback at the Line Level that is a future Takeback at the Claim Level.

The Takeback is the only Transaction on the Remit

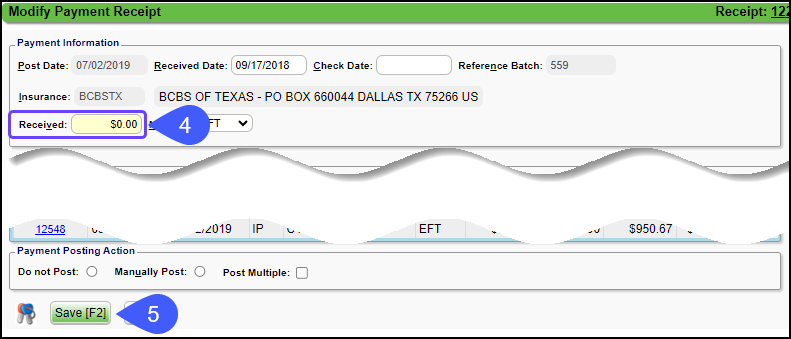

Change the Receipt Amount to $0.00

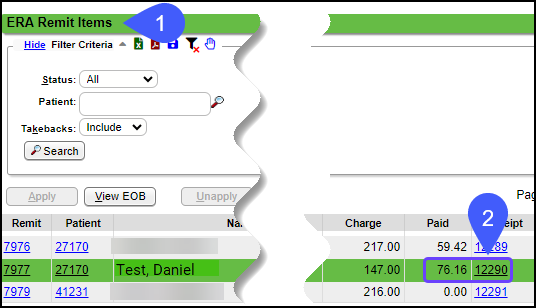

If there are no other Transactions on the Remit, you may need to change the Receipt Total to $0.00, or if the future Takeback is on the line level in the body of the Remit, change the Receipt for that specific ERA Remit Line item to $0.00.

- Go to the ERA Remit page.

- Select the Receipt number that represents the future Takeback.

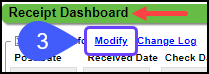

- On the Receipt, select Modify.

- Enter 0.00 in the Received field.

- Select Save [F2].

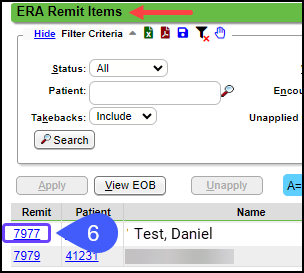

- Return to the Remit.

- Update the Remit Status:

- Select Save [F2].

Post the Takeback

When the Takeback is not actually taken on the current Remit, the Takeback should be posted when the Remit is received where the actual Takeback is being taken.

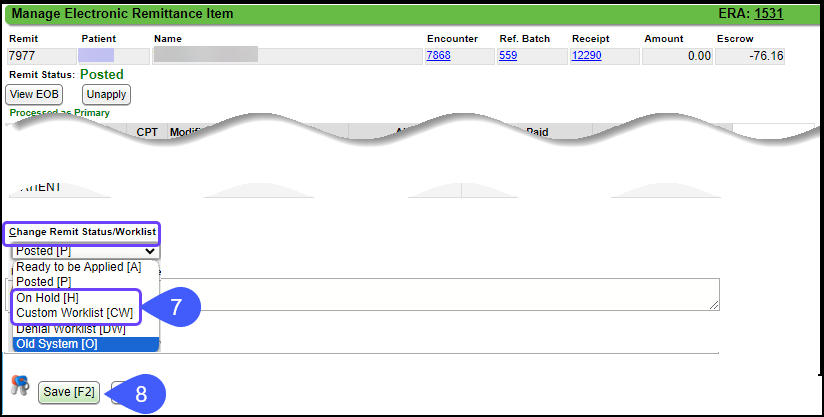

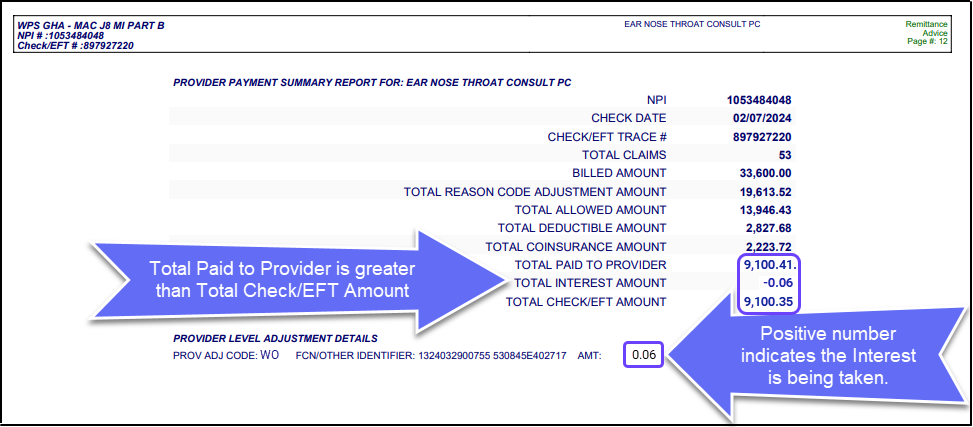

When the Total Paid to Provider is greater than the Total Check/EFT Amount, this is usually an indication that the Takeback is being done or Interest is being taken on this Remit.

Example 1: The difference between the Total Paid to Provider ($9,100.41) and the Total Check/EFT Amount ($8,935.00) is $165.33 which is the positive amount listed in the Provider Level Adjustment Details.

- The Takeback should be posted with the other Transactions on this Remit.

Post the Provider Level Adjustment (Takeback)

Example 2: Interest is being taken by the Payer.

- Interest that is being taken by the Payer is $0.06, which is the difference between The Total Paid to Provider ($9,100.41) and the Total Check/EFT Amount ($9,100.35).

Post Interest

future-takeback-notifications-or-interest-on-the-remit30 seconds ago

Insurance Refunds/Takebacks/Reversals

Future Takeback Notifications or Interest on the Remit

Related Articles

ERA Takeback/Refund/Reversal

Post as Remitted vs. Using the Takeback Process Using Post as Remitted on the ERA completes a Takeback exactly as the Remit dictates in the ERA. In some cases, the Manual Post button will be used to do the Takeback when the ERA does not calculate ...Partial Insurance Takebacks/Refunds

Use these methods when the insurance takes back only a portion of the money originally paid. This can be in the form of a physical check or a Payment that is automatically deposited in the bank (EFT). Manually Posting a Partial Takeback from a Paper ...Patient Refunds

Patient Refunds The following steps show the process of refunding Patient Credit Balances. If any part of the money is currently in escrow it needs to be posted in full before proceeding. A Patient credit balance is necessary to post a Patient ...Full Insurance Refunds & Takebacks Posted Manually

There is a specific workflow for manually posting Insurance Refunds. If there are other Payments on the Remit, the Refund(s) must be posted before the Payments are posted. Attach to a Reference Batch before beginning the Refund process. It is ...Manually Post Interest or Penalty

Post Interest to an Interest Account Create an Interest Account: Setup for Manually Posting Interest and Penalty. Set up an Interest Payment and an Interest Adjustment Transaction Code if it has not already been done. If you do not have an Interest ...