Sales Tax

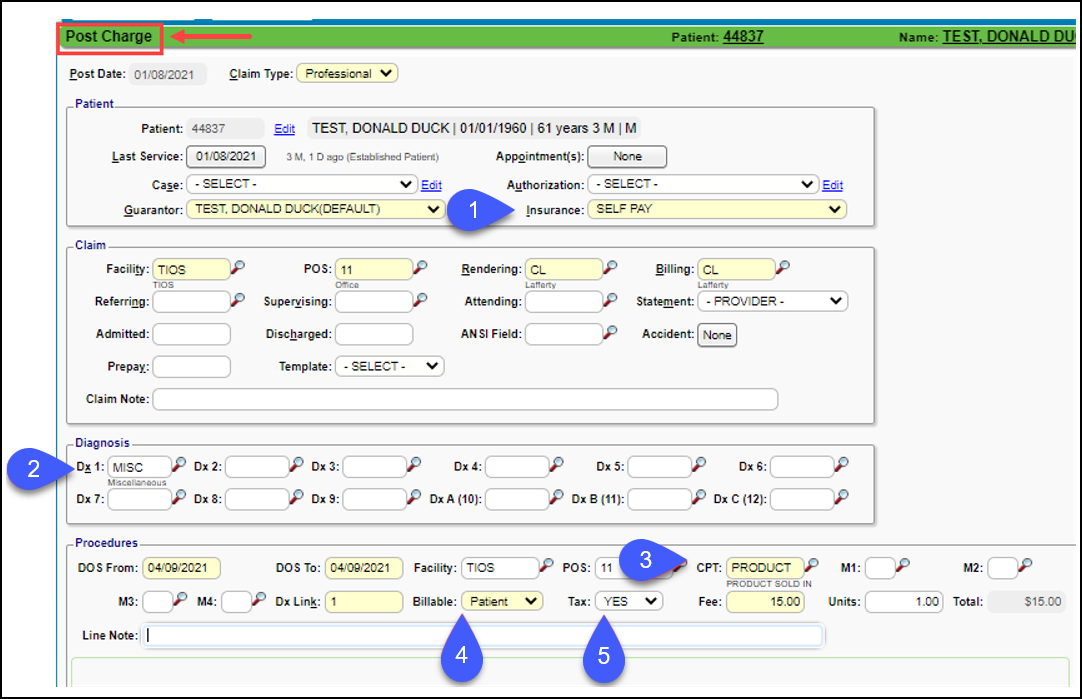

On the Post Charge screen, select Self Pay from the Insurance dropdown list.

Select MISC from the Dx1 lookup.

Enter or look up the CPT®.

Choose Billable Party. The CPT can be set up in the Procedure Code Library to default to Patient Only if CPT will never be sent to Insurance. It can be overridden on the Post Charge screen.

If the System Setting for TAXABLECHGLN is set to Yes, the Tax field will be available, and if the CPT is set up correctly in the Procedure Codes Library for adding Taxes, Yes will default in the Tax field. This field can be overridden manually.

Tab through the fields until the Charge appears in the window. The tax is not calculated until the charge is saved, therefore, you will not see the Tax line item on this screen before saving.

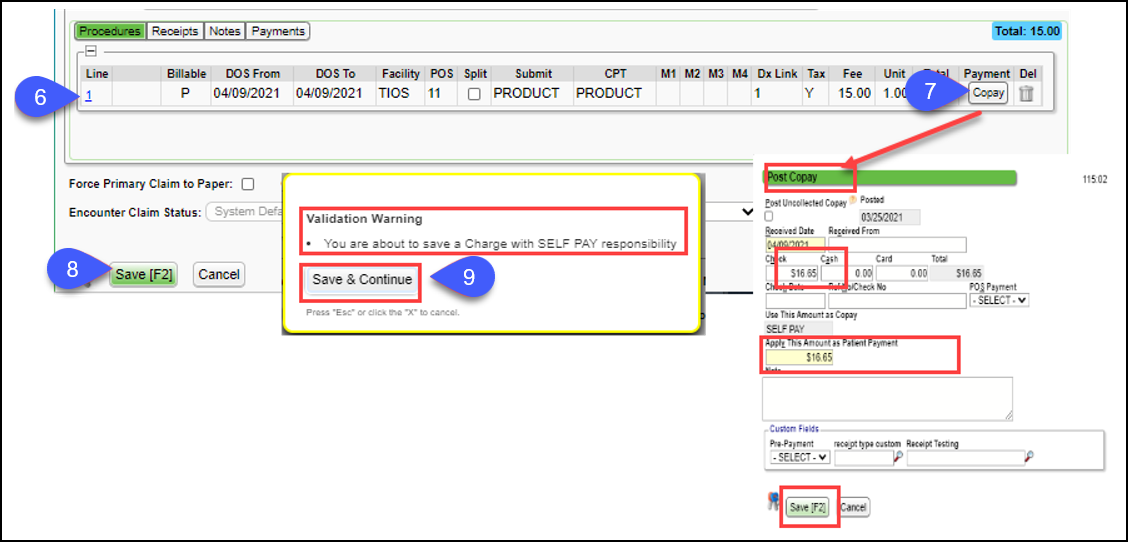

To post the Payment at this time, click Post Copay. Make sure the Copay amount is zero and the Apply This Amount as Patient Payment field is completed. If not posting the Payment, skip to Step 8.

Select Save [F2].

Select Save & Continue on the Self Pay Validation Warning pop-up.

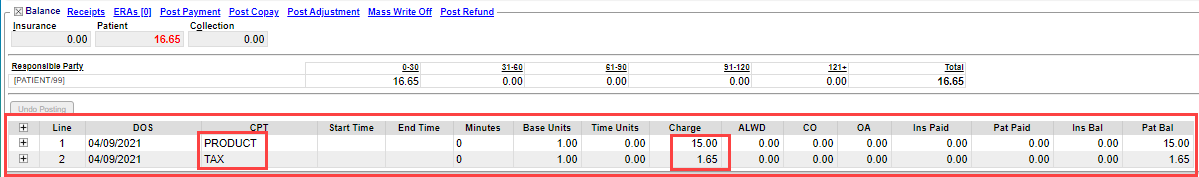

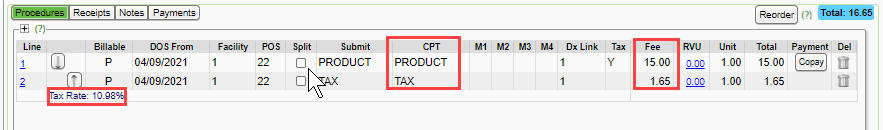

Tax is calculated using the percentage setup on the Tax CPT code and is added when the charge is saved.

Encounter Dashboard View

Modify Charge View after saving

Learn More

CPT® copyright 2019 American Medical Association. All rights reserved.

Related Articles

Sales Tax Report

Sales Tax activation and setup must be done to report on Sales Taxes. The Sales Tax Report shows line item Sales Tax collected with: Total of taxes collected Total for the Charges where the Sales Tax was applied. Columns Encounter # DOS: Date of ...Sales Tax Activation and Setup

Sales Tax can be added to individual Charge Lines on the Charge Entry screen. Activate the Sales Tax Option Admin > System Settings > Charges > TAXABLECHGLN If YES is chosen for the System Setting, a Yes/No Tax field is added to the Charge Entry ...State Tax

State Tax can be set up to be added to the Insurance screen. Contact Support or your Implementation Manager to activate this feature. State Tax is only billed to the Primary Insurance. State Tax is calculated from the Charged Amount, not the Allowed ...Sales and State Taxes (Table of Contents)

Contents Sales Tax State TaxTaxes Collected Report

This is a Report of Sales Tax that has been collected.