Sales Tax Activation and Setup

Sales Tax can be added to individual Charge Lines on the Charge Entry screen.

Activate the Sales Tax Option

Admin > System Settings > Charges > TAXABLECHGLN

- If YES is chosen for the System Setting, a Yes/No Tax field is added to the Charge Entry screen. If there are Charge lines flagged as taxable, a CPT® line is added to the Charge representing the calculated tax amount. The tax calculation is based on the fee percentage that is added to the CPT Code, TAX, in the Procedure Code Library.

Setup the Tax Procedure Code and Percentage

The tax calculation is based on the Fee percentage that is added to the CPT Code, TAX, in the Procedure Code Library.

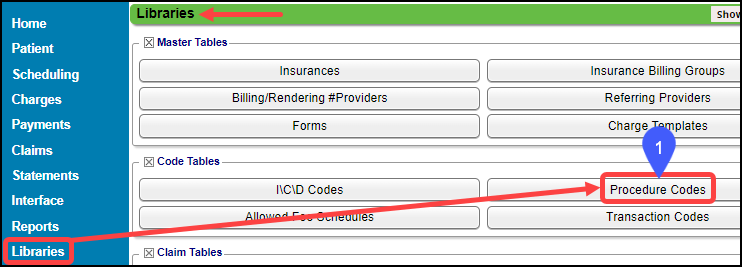

- Libraries > Procedure Codes

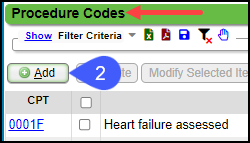

- If a TAX Procedure Code does not exist, select the Add button.

- CPT: TAX

- Description: TAX

- Billable: Select Patient Only.

- Taxable: Select the checkbox.

- Fee: Enter the Tax percentage.

- If the Tax is 6%, enter 6.00 in the Fee field on the CPT Code, TAX, which translates to 6 % when the System calculates the Tax.

- Select Save [F2].

Multiple Locations using Different Sales Tax Percentage

For databases that have clinics in multiple locations with different Sales Tax percentages, another percentage can be added on the Service Facility.

- Adding the Tax Percentage on the Service Facility overrides the setting on the Procedure Code Percentage setting.

- This rate will be applied to all taxable line items for the specific Facility.

Add the Tax Percentage Rate to the Facility

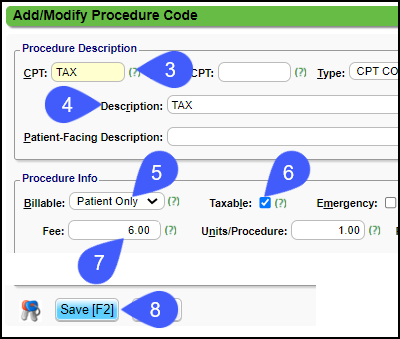

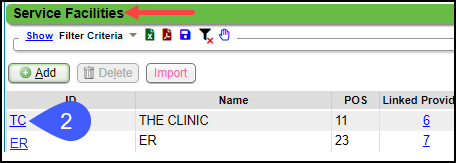

- Go to Libraries > Service Facilities button.

- Select the Facility ID.

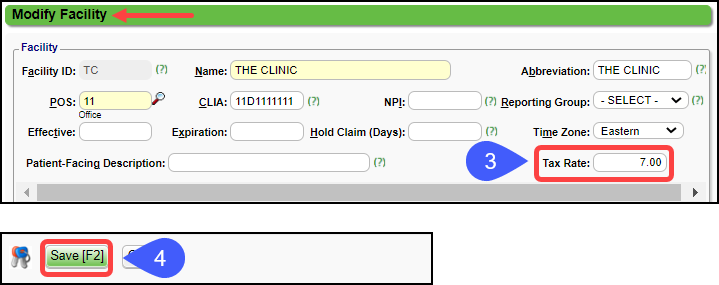

- On the Modify Facility screen, enter the Tax Percentage for that specific location in the Tax Rate field.

- Select Save [F2].

Related Articles

Sales Tax

Before using Sales Tax, it must be activated and set up. Post Sales Tax On the Post Charge screen, select Self Pay from the Insurance dropdown list. Select MISC from the Dx1 lookup. Enter or look up the CPT®. Choose Billable Party. The CPT can be set ...Sales Tax Report

Sales Tax activation and setup must be done to report on Sales Taxes. The Sales Tax Report shows line item Sales Tax collected with: Total of taxes collected Total for the Charges where the Sales Tax was applied. Columns Encounter # DOS: Date of ...Wind River Lane Terminal Setup

Initial Setup To set up the credit card device successfully, an internet connection is required, either through an Ethernet cable or Wi-Fi, depending on the chosen device. Verify that an Ethernet port or nearby router is accessible from your ...State Tax

State Tax can be set up to be added to the Insurance screen. Contact Support or your Implementation Manager to activate this feature. State Tax is only billed to the Primary Insurance. State Tax is calculated from the Charged Amount, not the Allowed ...Administration Articles

Administrator's Setup Workflow Billing Resources CARC Management & Denial Analysis Change Log Charge Management Rules Custom Fields Custom Queries Duplicate Patients and Insurances ERA Management Rules Job Scheduler Mandatory Fields Mass Write Off ...