State Tax

State Tax can be set up to be added to the Insurance screen.

Contact Support or your Implementation Manager to activate this feature.

State Tax is only billed to the Primary Insurance.

State Tax is calculated from the Charged Amount, not the Allowed Amount, which can cause the secondary adjustments to be incorrect.

Therefore, the State Tax is calculated based on the Primary Payer setting in the Insurance Library.

All other Payers on the Encounter are not in consideration for State Tax.

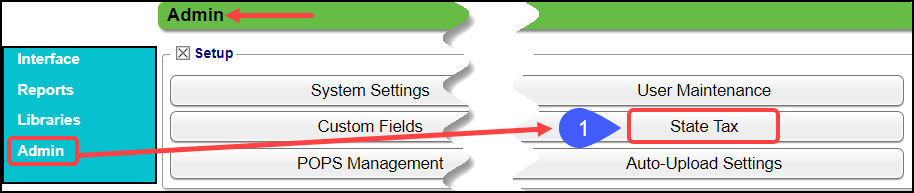

Add the State Tax Profiles

- From Admin on the Left Side Menu, select the State Tax button.

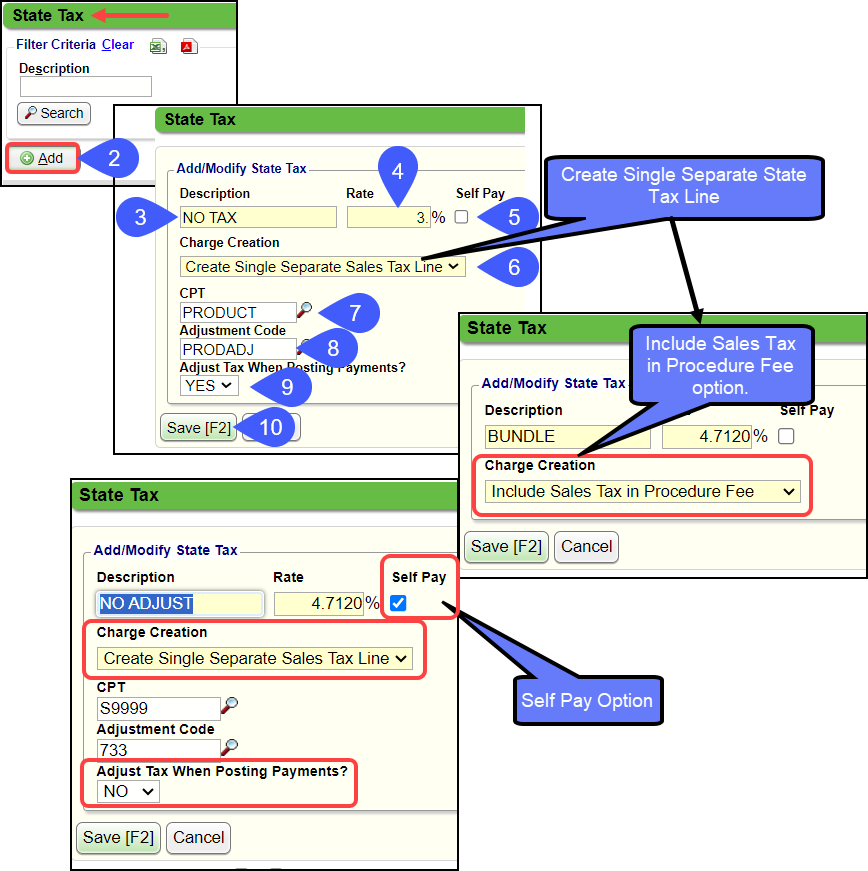

- Select the Add button.

- Add a Description: No Tax is the Default and does not need to be added.

- Examples: Bundle, Adjust, No Adjust

- Rate: Enter the Tax Percentage Rate.

- Self Pay: Select the checkbox for Self Pay Items.

- Charge Creation Options:

- Include Sales Tax in Procedure Fee

- If this option is selected, skip to step 10.

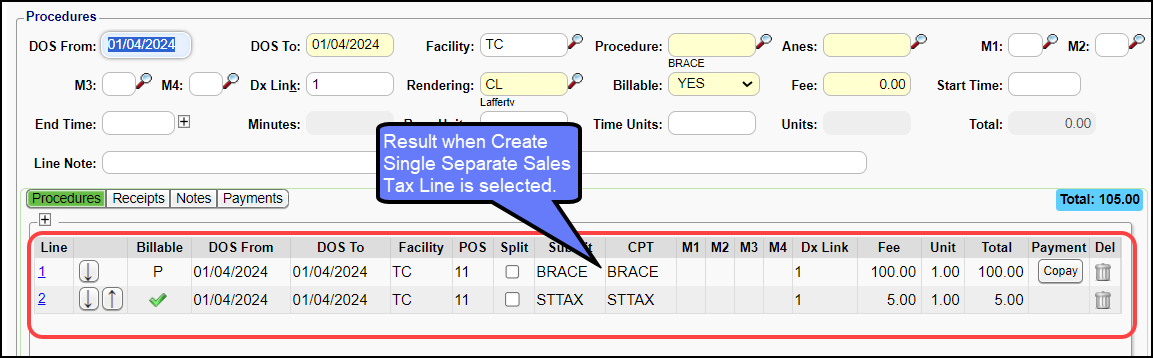

- Create Single Separate Sales Tax Line.

- Selecting this option, will open the fields below.

- CPT®: Select or enter the CPT for the Tax line. Ex: STTAX.

- Adjustment Code: Select an Adjustment Code to use for adjusting the State Tax.

- Transaction Code: Set up a specific Adjustment Code to use for the Write-Off Code.

- Adjust Tax When Posting Payments?: Select Yes or No.

- Select Save [F2].

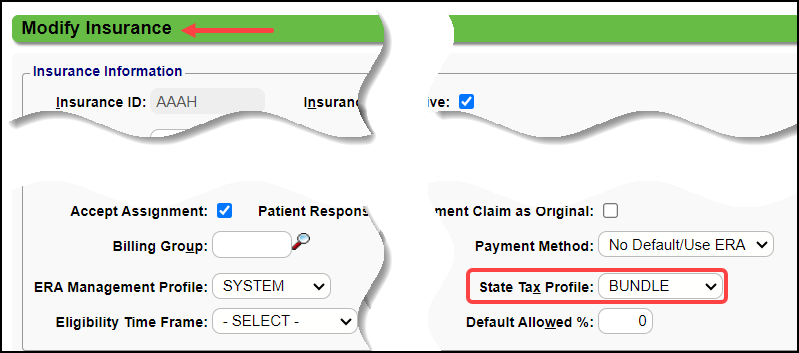

Select the State Tax Profile on the Modify Insurance Screen

Libraries > Insurance > Modify

- In the Settings Panel, select the applicable State Tax Profile.

- Select Save [F2].

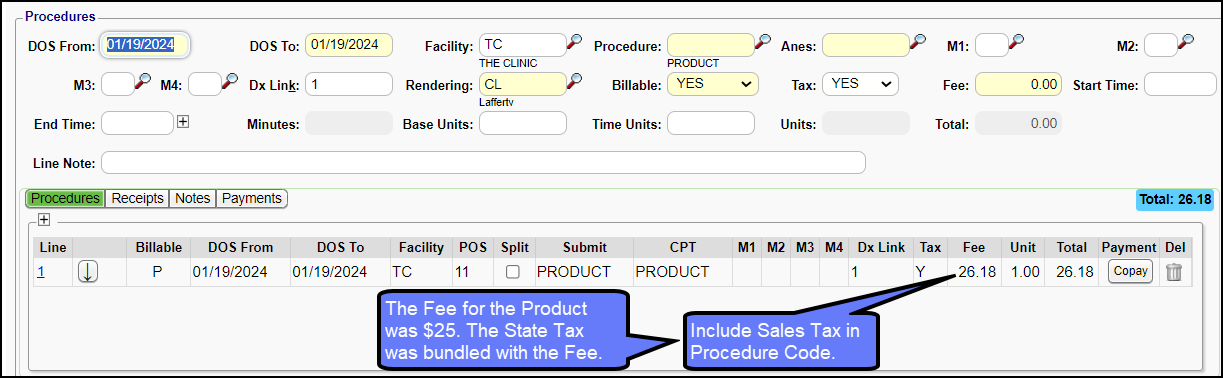

Bundled

Separate Tax Line Item

Related Articles

Sales and State Taxes (Table of Contents)

Contents Sales Tax State TaxSales Tax

Before using Sales Tax, it must be activated and set up. Post Sales Tax On the Post Charge screen, select Self Pay from the Insurance dropdown list. Select MISC from the Dx1 lookup. Enter or look up the CPT®. Choose Billable Party. The CPT can be set ...Sales Tax Report

Sales Tax activation and setup must be done to report on Sales Taxes. The Sales Tax Report shows line item Sales Tax collected with: Total of taxes collected Total for the Charges where the Sales Tax was applied. Columns Encounter # DOS: Date of ...Sales Tax Activation and Setup

Sales Tax can be added to individual Charge Lines on the Charge Entry screen. Activate the Sales Tax Option Admin > System Settings > Charges > TAXABLECHGLN If YES is chosen for the System Setting, a Yes/No Tax field is added to the Charge Entry ...Clearinghouse Rejection: If the Subscriber State (AB) is a Canadian province then Subscriber Zip Code (AB T8L0S2) must be six characters.

CE: A7:0 If the Subscriber State (AB) is a Canadian province then Subscriber Zip Code (AB T8L0S2) must be six characters. The format (ANANAN) (A = ALPHA, N = NUMERIC) (no spaces) Example of a Canadian Zip Code: L2J4E2