A/R by Expected Amount

This feature allows clients to forecast the expected amount that will be collected on unpaid balances. Using A/R by Expected amount instead of the Billed amount gives a more realistic assessment of the A/R.

The "A/R" Filter on the Interactive Aging allows you to look at the A/R by

Billed (amount)

Expected (amount)

- How the System determines the Expected Amount:

- First, it looks at the loaded Allowed Fee Schedule.

- If there is no fee schedule, it looks at the Insurance Library.

- If nothing is designated in the Insurance Library, it looks at the System Settings.

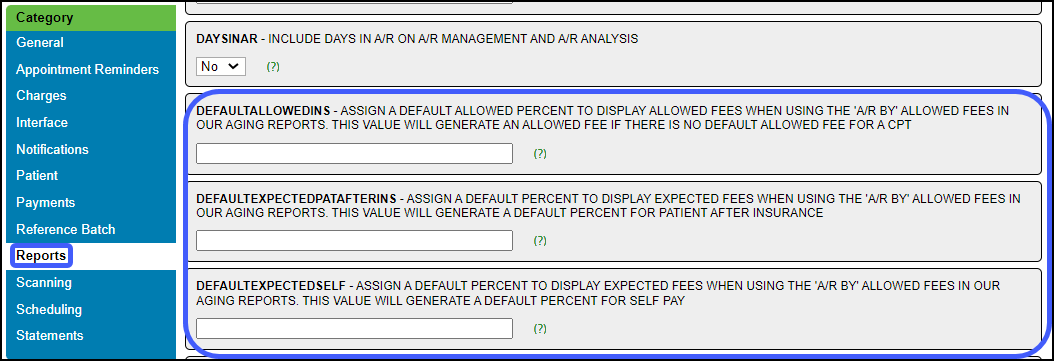

Add System Settings in the Reports Category

Default Allowed %: Percentage of the Charges that you expect to be paid for CPTs that do not have a posted allowed amount.

- This applies to all Charges for every Payer where no Allowed Amount is posted.

- To set up a specific Insurance, use the Insurance screen in the Insurance Libraries.

Default for Self-Pay: Assign default percentage for Self Pay Default.

- This is what the practice normally expects to receive from a self-pay patient.

- The percentage is applied to the current Patient Balance, not the original fee.

Default for Patient-After Insurance: Assign default percentage for Patient Responsibility AFTER Insurance.

- This is the amount the practice normally expects to receive from a secondary/tertiary Insurance after the Primary Insurance has adjudicated.

- The percentage is applied to the current Insurance Balance.

Example Default %

- System Setting: 80% (affects all Payers where an Allowed Amount has not been posted).

- Interactive Aging Filter A/R by: Allowed Amount

- There are 2 Line Items on the Claim.

Line Item 1

- Allowed Amount is not posted.

- Charge Fee: $125

- The calculated Allowed Amount: 0.80 x 125.00 = $100.00.

- Expected amount to be collected: $100.00

Line Item 2

- Allowed Amount is posted: $75 (Overrides System Setting of 80%).

- Charge Fee: $115

- Expected adjustment: $40.00

- Expected amount to be collected: $75.

Related Articles

Interactive Aging: Real-Time A/R View

Interactive Aging: Real-Time A/R View This report is not meant to balance to the Period End Report. The Interactive Aging Report is a real-time A/R Report. It can be grouped and aged dynamically. If the Bill Date is chosen as the Aging Date, and ...ERA Generated an Incorrect Receipt Amount

If an ERA generated an Incorrect Receipt Amount because it was not in a standard format, change the Receipt amount manually. Example: The ERA actually paid $51.03 but a Receipt was generated for $175.21. Make an ERA Receipt Correction Select the ...A/R Analysis

Gives a Day by Day, Week by Week, Month by Month, or Year by Year tracking of changes in the A/R. This report allows you to Group By and Sub-Group By. If the Days in A/R is blank: The System was not able to calculate a valid value. This is usually ...A/R Reports Overview

A/R Reports do not include Incomplete Charges. Account Receivable Reports Practice Analysis A/R Analysis A/R Management Year End Interactive Aging Report Aging by Patient BI: A/R Dashboard Date Filters When comparing reports, be sure you use the same ...A/R Review and Troubleshooting

If you are concerned about your A/R, or just want to learn more about the health of your practice, follow the steps below to take a deep dive into your A/R. Executive Summary The Executive Summary Report shows A/R broken down by month and split into ...